child care tax credit 2020

Ad TurboTax Has Your Back. For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Up to 3600 per qualifying dependent child under 6 on Dec.

. Calculate Your Child And Dependent Care Tax Credit. Complete IRS Tax Forms Online or Print Government Tax Documents. The child and dependent care tax credit is worth anywhere from 20 to 35 of qualifying care expenses.

It has gone from 2000 per child in 2020 to 3600 for each child under age 6. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The percentage depends on your.

For tax year 2020 the maximum amount of care expenses youre allowed to claim is 3000 for one person or 6000. Ad TurboTax Has Your Back. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons.

The credit is computed based. How much was the Child and Dependent Care Credit worth in previous years. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

For information on qualifying for the federal credit see federal IRS Publication 503 Child and Dependent Care Expenses. Up to 3000 per qualifying dependent child 17 or younger on Dec. For 2020 this credit was worth up to 20 to 35 of up to 3000 of child care or similar costs for a child under 13 or up to 6000 for 2 or more dependents.

There is no upper limit on income for claiming the credit. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Greater than 60000 and up to 150000.

The child care tax credit was lower in previous years. Ad Access IRS Tax Forms. 59 minus 2 percentage points for each 5000 or part of above 40000.

The credit is calculated. In other words families with two kids who spent at least 16000 on day care in 2021 can get 8000 back from the IRS through the expanded tax credit. This credit has been greatly changed as part of the.

If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you could claim a tax credit of either. For each child ages 6 to 16 its increased from 2000 to 3000. The exact amount depends on the.

Let Us Find The Credits Deductions You Deserve. Below the calculator find important information regarding the 2020 Child and Dependent Care Credit CDCC. 51 minus 2 percentage points for each 3600 or part of above 60000.

How much is the credit. Starting in 2021 the Child and Dependent Care Tax Credit became a refundable tax credit in contradistinction to a nonrefundable tax credit. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Prior to the American. If you cant claim the Child and Dependent Care Credit or are looking for more ways to reduce your tax bill consider these tax credits and deductions. The child and dependent.

In brief for the 2021 tax year you could get up to 4000 back for one child and 8000 back for care of two or more. Sometimes before and after-school programs qualify but it must be for the care of the child rather than just leisure. Calculating the Child and Dependent Care Credit until 2020.

In prior years the maximum return for the credit was. Costs at the kindergarten level such as nursery school can. For 2020 this credit was worth up to 20 to 35 of up to 3000 of child care or similar costs for a child under 13 or up to 6000 for 2 or more dependents.

In 2020 the credit was worth up to 3000 for. This means that if your income is. For the 2021 tax year the child tax credit offers.

It also now makes 17-year-olds eligible for. You must reduce the expenses primarily for the care of the individual by the amount of any dependent care benefits provided by your employer that you exclude from gross. Complete Edit or Print Tax Forms Instantly.

Let Us Find The Credits Deductions You Deserve.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Quebec S Childcare Program At 20 Inroads

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

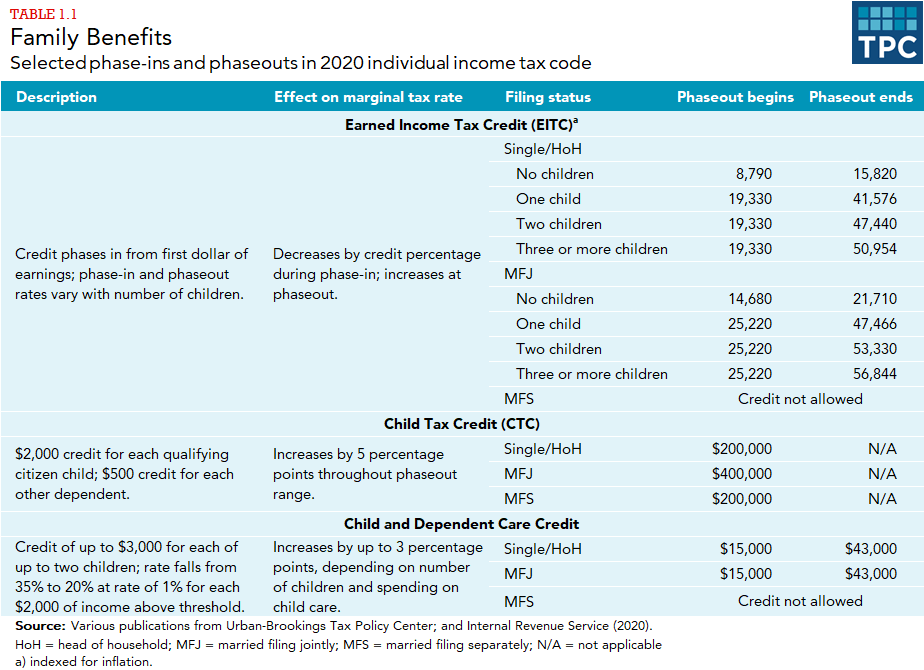

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

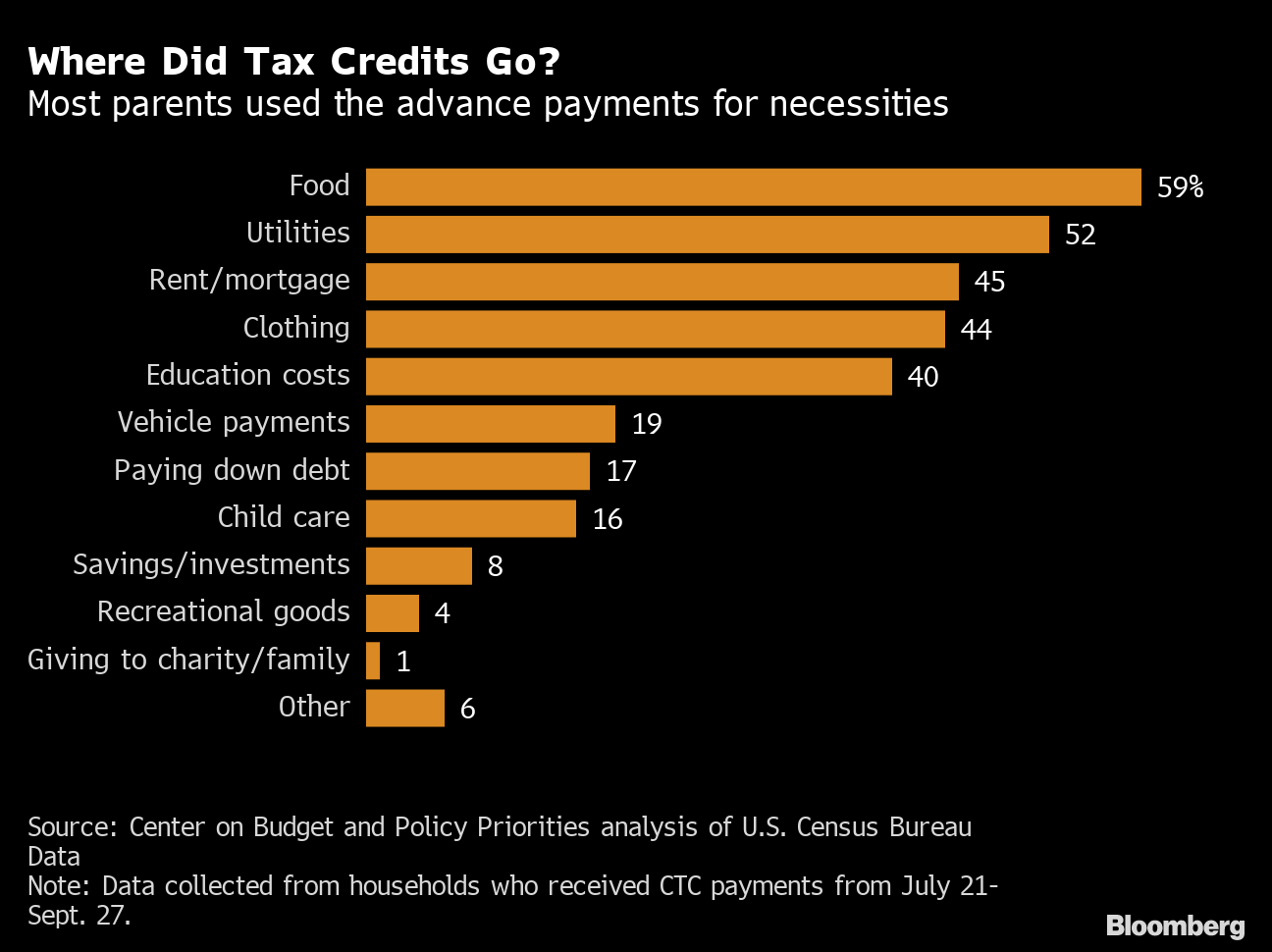

Child Tax Credit 2021 Joe Manchin Opposes Aid Parents Are Using For Food Rent Bloomberg

Wtform Child Tax Credit Letter 6419 Explained Youtube

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

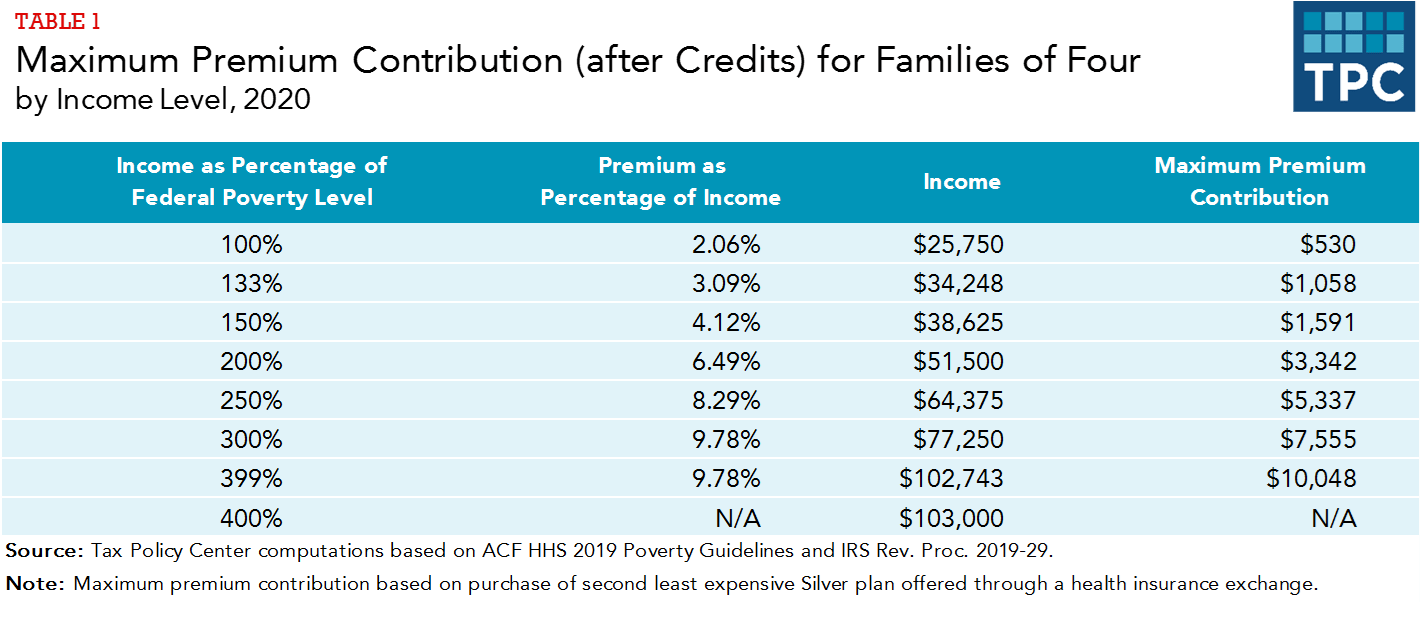

What Are Premium Tax Credits Tax Policy Center

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

The 2021 Child Tax Credit Implications For Health Health Affairs

Making Ontario Better For The People Ontario Ca

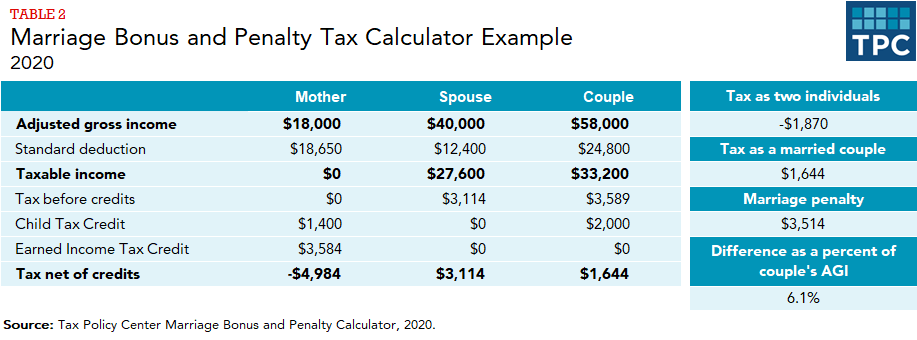

What Are Marriage Penalties And Bonuses Tax Policy Center

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center